Cost of Goods Sold (COGS) is a critical financial metric that provides deep insights into a business's operational efficiency and profitability. This comprehensive guide explores the intricate world of COGS, offering business owners and entrepreneurs a strategic framework for understanding, calculating, and optimizing direct production costs.

You're a CEO looking into the sales reports, celebrating a wonderful month with a full of profit. But something doesn't add up. Despite the impressive revenue, your profits seem...underwhelming. This is where understanding Cost of Goods Sold (COGS) becomes mandatory.

COGS represents the direct costs of producing the goods or services you sell. It's the silent partner to revenue, revealing the true profitability of your business. In this blog post, we'll demystify COGS, break down its calculation, and equip you with actionable strategies to optimize this vital metric.

What Exactly is Cost of Goods Sold (COGS)?

At its core, COGS is more than just a number on a financial statement. It's a comprehensive breakdown of the direct costs involved in creating your product or service.

What COGS Includes:

Raw materials

Direct labor costs

Manufacturing overhead directly tied to production

What COGS Does NOT Include:

Indirect expenses like marketing salaries

Rent

Administrative costs

Real-World Example: For a bakery, COGS would include:

Flour, sugar, butter (raw materials)

Baker's wages (direct labor)

Oven operating costs (manufacturing overhead)

Actionable Tip: Maintain meticulous records of all direct production costs to accurately calculate your COGS.

Cracking the COGS Formula

The COGS formula is straightforward: COGS = Beginning Inventory + Purchases - Ending Inventory

Pro Tip: Use accounting software to automate COGS calculations, reducing errors and saving time.

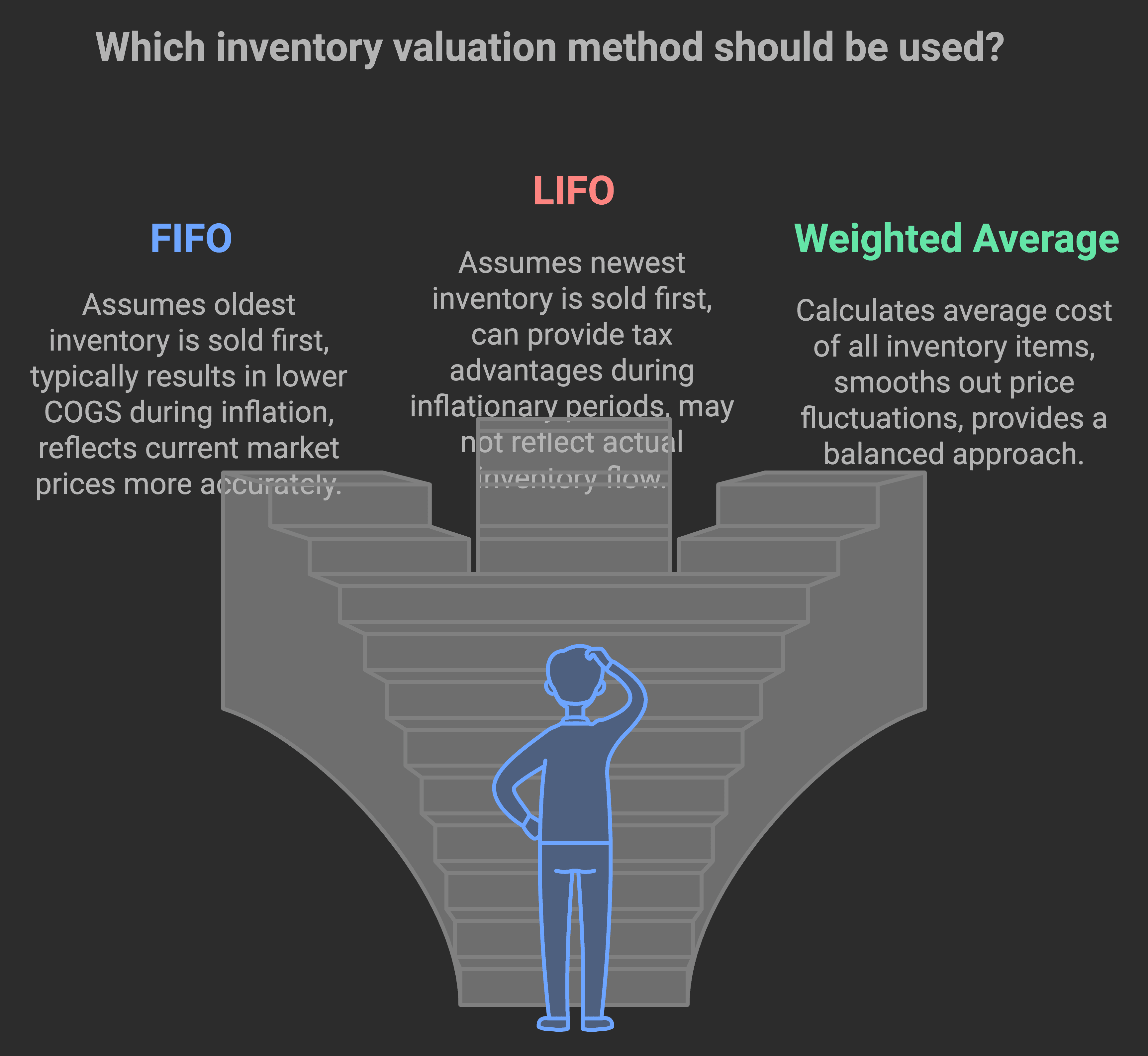

FIFO, LIFO, or Weighted Average?

Three primary methods exist for valuing inventory, each with unique implications:

FIFO (First-In, First-Out)

Assumes oldest inventory is sold first

Typically results in lower COGS during inflation

Reflects current market prices more accurately

LIFO (Last-In, First-Out)

Assumes newest inventory is sold first

Can provide tax advantages during inflationary periods

May not reflect actual inventory flow

Weighted Average

Calculates average cost of all inventory items

Smooths out price fluctuations

Provides a balanced approach

Real-World Scenario: If you purchased goods at $10/unit earlier in the year and then at $12/unit later, your chosen valuation method can significantly impact your COGS calculation.

Actionable Advice: Consult a qualified accountant to determine the most appropriate method for your specific business context.

The COGS Connection: Unveiling the Impact on Your Bottom Line

COGS isn't just a number—it's a critical profitability indicator:

Gross Profit = Total Revenue - COGS

Gross Margin = (Total Revenue - COGS) / Total Revenue

Powerful Insight: Two businesses with identical revenue can have dramatically different profitability based on their COGS. A company with a 50% gross margin is substantially more profitable than one with a 30% margin.

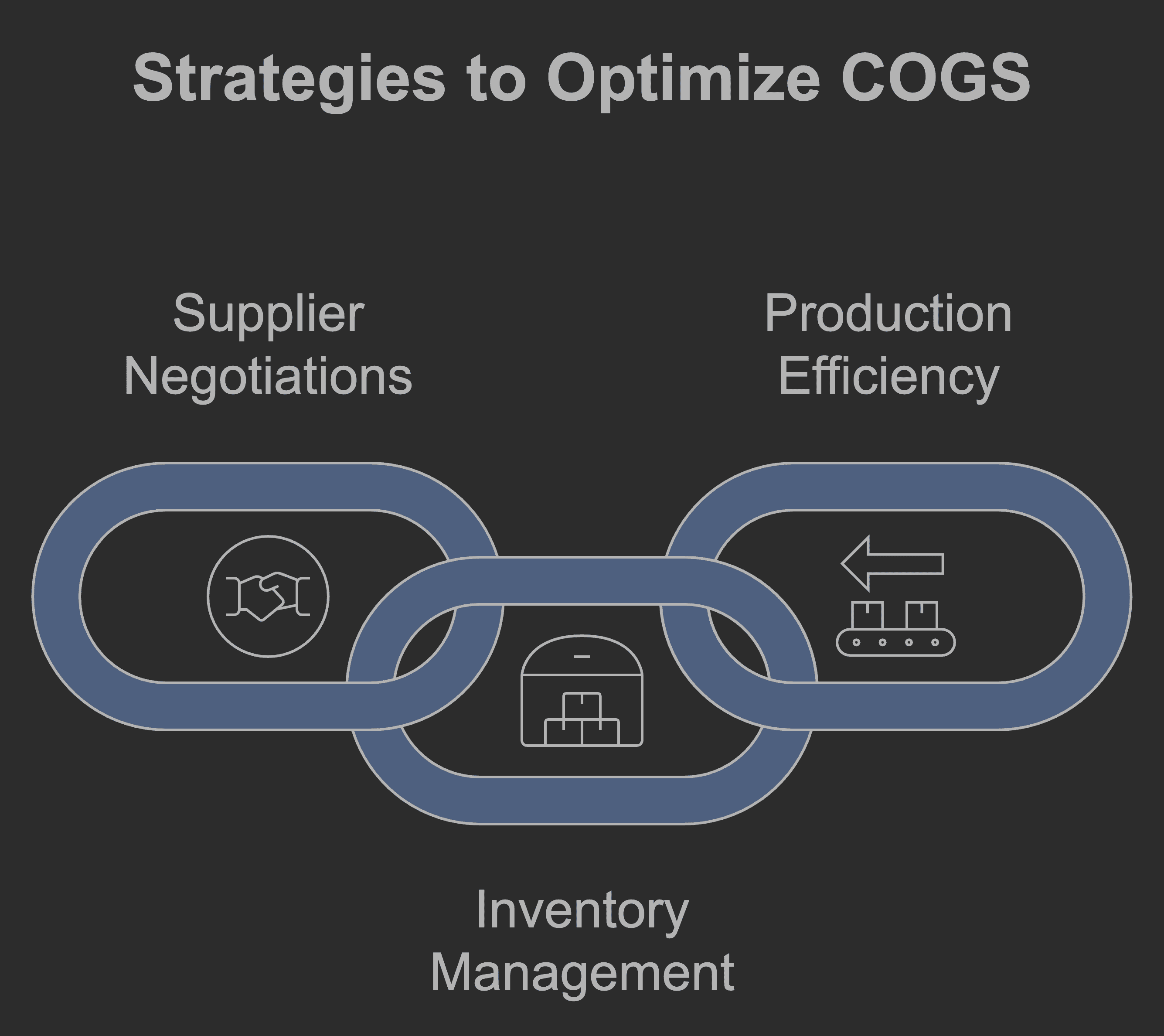

Strategies to Optimize Your Cost of Goods Sold

Practical strategies to manage and reduce COGS:

Supplier Negotiations

Seek bulk discounts

Negotiate early payment terms

Explore alternative suppliers

Inventory Management

Minimize waste

Optimize storage costs

Implement just-in-time inventory systems

Production Efficiency

Reduce labor waste

Improve manufacturing processes

Invest in technology that streamlines production

Success Story: A clothing retailer reduced COGS by negotiating better fabric prices through larger, committed orders—directly improving their per-unit profitability.

Conclusion

Cost of Goods Sold is more than an accounting term—it's the heartbeat of your business's profitability. By understanding its components, calculation, and profound impact, you gain the power to make informed decisions that drive financial success.

Remember, managing COGS is an ongoing process. Continuously review your costs, explore optimization strategies, and adapt to changing market conditions. Your commitment to understanding and managing COGS will empower you to price competitively, manage inventory efficiently, and ultimately watch your profits soar!

Related Article