Holidays are a time for celebration, rest and relaxation, and for many people, a time to enjoy paid time off from work. However, some holidays carry a different weight when it comes to compensation, as employees may be entitled to receive time and a half pay for working on specific holidays.

This extra pay's purpose is to compensate employees for working on a day that is a holiday, and it may be mandatory or optional depending on the employer and the employee's contract.

In this blog, we will discuss the holidays that typically offer paid time and a half.

Do Paid Holidays Affect Your Paycheck?

Yes, your pay is oftentimes affected by paid holidays. Holiday pay is frequently included in your total earnings for that pay period and is added to your normal salary for that pay period. Depending on your employer's policy and your employment contract, if you work on a holiday and are eligible for holiday pay, it may be paid at your usual rate or at a premium rate, such as time and a half.

You might receive holiday compensation in addition to your usual income if your company recognizes the holiday as a paid holiday and you don't work on it. Furthermore, having a paid holiday off could have an impact on your overall income for that pay period because you won't be compensated for the hours you were required to work.

You might also like:

Doing the Opposite of Procrastination: Learn How to Cope With It Professionally

Simplify Your Life: A Prioritization Framework for Busy Schedules

What Holidays Do You Get Paid Time And a Half?

Depending on the company, the sector, and the region, there may be different holidays for which an employee is entitled to time and a half pay. In some circumstances, the law specifies which holidays are paid holidays and how much should be paid.

In other circumstances, the employer is free to choose the holidays and the pay. Christmas Day, New Year's Day, Thanksgiving Day, and Independence Day are a few popular holidays that may be paid at a time and a half. To find out which holidays are paid holidays and what the pay for working on those holidays is, it's vital to check with your employer or refer to your employment contract.

If you want to calculate time and a half on holidays you need to accurately know how much time you have spent. BeforeSunset AI can help you with that! Using BeforeSunset AI you can accurately see how much time you have spent for each task. See your work earn your worth. You can try BeforeSunset AI for free.

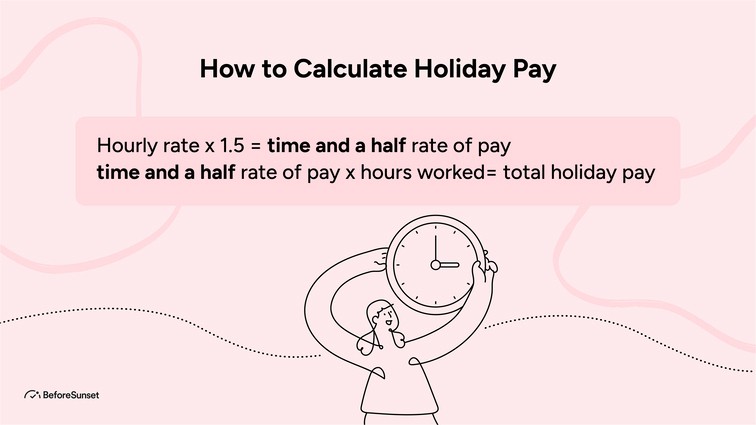

How to Calculate Holiday Pay?

Do you want to calculate your holiday pay rate? It is fairly easy, what you must do is to know your rate and how many hours you worked during the holiday.

First find out the employee's regular pay rate this is the hourly wage that the worker gets for regular, non-overtime work. Then add 1.5 to the regular rate of pay. Next up, multiply the time-and-a-half rate by the number of hours worked on the holiday.

That is how you will know how much the worker is owed in holiday pay for the hours they worked on that holiday.

To exemplify this, if an employee makes $20 per hour and works 8 hours on a holiday for which they are entitled to time and a half pay, the calculation would look like this:

$20 x 1.5 = $30 (time and a half rate of pay)

$30 x 8 hours = $240 (total holiday pay)

Are There Conditions For Employees to Receive Holiday Pay?

Yes, there are requirements that workers must meet in order to be eligible for holiday pay. These requirements may differ based on the employer and the sector, however, the following are some These requirements can change from one workplace to another but they are usually some of the standard ones.

To be eligible for holiday compensation your workplace may want you to have specific hours you have worked. Also If you want to be able to get this pay you must request it in advance. Of course, not everyone can be eligible for holiday pay, such as part-time workers.

Is it Federal Law to Pay Time-and-a-Half on Holidays?

No, federal law does not mandate paying overtime on holidays. The Fair Labor Rules Act (FLSA), a federal law that governs minimum wage and overtime pay standards, does not require employers to pay employees time and a half for working on holidays. State and local governments may have different policies regarding holiday compensation.

Employers who fall under the FLSA's jurisdiction may choose to pay time and a half for working on holidays as a benefit to their personnel or as a result of a collective bargaining agreement or employment contract. It is crucial to speak with your employer or consult your employment contract when deciding the holiday pay policy that applies in your situation.

Holiday Policy in the Private Sector

There are numerous different industries and employer types in the private sector. Paid holidays are a benefit that certain companies may offer to their employees, while others do not.

The holidays that are specifically recognized, the requirements for eligibility, and the pay rate for employees who are scheduled to work on certain holidays are all specified in the employer's holiday pay policy. Although employees are permitted to take floating holidays on any day of the week, some firms also offer a predetermined number of paid vacation days annually.

Do You Have to Give Employees Time Off on Holidays?

Businesses are not required by the federal government to give their employees holiday time off. In accordance with the Fair Labor Regulations Act (FLSA), federal legislation that establishes minimum wage and overtime compensation standards, employers are not permitted to give their workers holiday time off.

Depending on the terms of a collective bargaining agreement or employment contract, certain companies may be compelled to do this as a benefit to their workers.

Holiday policies that specify the precise holidays that are recognized, the eligibility requirements and the pay rate for staff who work on certain holidays may be created by employers who choose to offer time off on holidays.

It is imperative to check your employment contract or with your employer to validate the company's holiday policy. It is important to consult the right authorities for the most recent information because different states and municipalities may have their own laws and regulations regarding vacation time off.

Do Employers Have to Allow Time Off for Religious Holidays?

Employers are not compelled by federal law to give employees time off for religious holidays. However, unless doing so would put an undue burden on the employer, companies are expected to make reasonable accommodations for employees' honestly held religious views or practices.

The employer may need to take into account honoring a request for time off for a religious holiday if the employee makes one unless doing so would place an excessive hardship on the company. An action that involves a lot of difficulty or money is referred to as an unreasonable hardship.

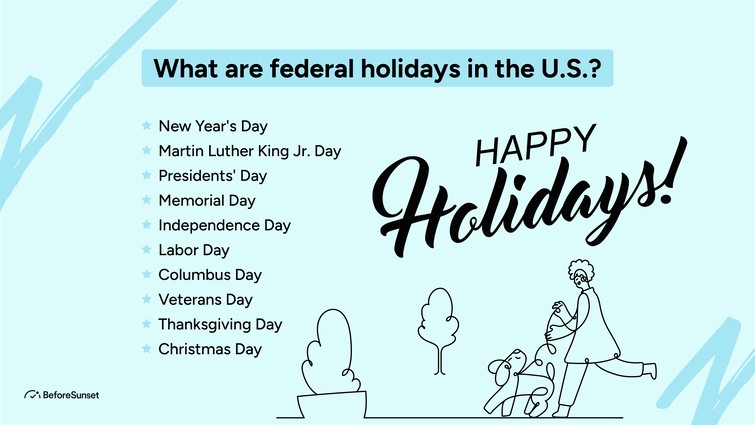

What are Federal Holidays in the U.S.?

The federal government recognizes 10 holidays each year. These holidays are observed by federal employees and are considered to be paid holidays. The 10 federal holidays are:

New Year's Day

Martin Luther King Jr. Day

Presidents' Day

Memorial Day

Independence Day

Labor Day

Columbus Day

Veterans Day

Thanksgiving Day

Christmas Day

What Is the Federal Holiday Pay?

The remuneration given to workers who work on U.S. government holidays is referred to as federal holiday pay. Federal holidays are particular days that the federal government recognizes as national holidays and on which many commercial companies as well as all non-essential federal government agencies are closed.

Private employers are not required by the federal government to offer holiday pay or to pay a higher rate for work done on federal holidays. However, some firms could voluntarily offer holiday pay or give workers more income if they work on certain holidays.

The policy could change if an employer decides to give holiday pay. The following structures are typical for holiday pay:

Regular Pay: Some firms give workers their normal rate of pay for the hours they put in on federal holidays.

Premium Pay: Other businesses may decide to provide workers who work on federal holidays a premium rate, frequently referred to as "holiday pay." This premium rate, which might vary based on corporate policy or collective bargaining agreements, is often greater than the standard hourly pay rate.

Additional Time Off: Employers may choose to provide workers who work on federal holidays additional time off in lieu of or in addition to extra compensation. This indicates that workers may replace additional time off on another day for the holiday.

Holiday Pay On Memorial Day

Memorial Day holiday compensation varies according on the regulations of the business and the relevant labor laws. Memorial Day is a federal holiday in the United States, and some companies opt to honor it by giving their staff members specific incentives. Some employers provide paid time off (PTO), which enables workers to take a day off without losing any of their earned vacation.

Some may have regulations regarding holiday pay that provide workers who work on Memorial Day extra pay. It's important to remember, though, that not all companies provide holiday compensation, and some workers could just get paid their usual salary on that particular day. The details are contingent upon the policies of the business, employment agreements, and compliance with regional labor regulations. Workers who want to know how Memorial Day is paid for at their specific employment may check with HR or their workplace regulations.

Is Thanksgiving Paid Time and a Half?

Thanksgiving isn’t automatically paid at time and a half for all employees. Holiday overtime laws don’t require private companies to provide additional compensation for working on legal holidays like Thanksgiving.

Whether full-time employees receive holiday time, a higher hourly rate, or compensatory time often depends on the company’s policies or a matter of agreement.

Many businesses, especially those operating during busy holidays, may offer some form of holiday pay to incentivize employees for time spent working. However, some workers may only receive unpaid time or no extra benefits at all.

Who is Eligible For Paid Holidays?

Depending on their employment and the unique holiday policy, different people could qualify for paid holidays. If an employee meets certain requirements, such as working a specific number of hours or remaining with an employer for a specific amount of time, they may be entitled for paid holidays.

All employees may be eligible for paid vacations at some businesses, while stricter criteria, such as full-time status, length of service, or union membership, may apply at other establishments.

You might also like:

Non-Exempt Employees from Overtime Pay

The Fair Labor Standards Act (FLSA) requires non-exempt employees to be paid time and a half for any hours worked exceeding 40 in a workweek. Unless the employer has a policy requiring time-and-a-half pay for work performed on holidays, a non-exempt employee who works on a holiday recognized by their firm as a paid holiday must be paid their regular rate of pay for the hours worked on that holiday.

FAQ

Is New Year's Day paid at time and a half?

New Year's Day pay at time and a half is not guaranteed. The pay rate is determined by the employer's policy or any relevant labor contracts.

Is Martin Luther King Jr. Day paid at time and a half?

Employers are not required to pay time and a half on Martin Luther King Jr. Day. Check with your employer’s policy or employment agreement for specifics.

Is Presidents' Day paid at time and a half?

Presidents' Day is not automatically paid at time and a half. Payment depends on the employer's holiday pay policy or negotiated labor agreements.

Is Memorial Day paid at time and a half?

Memorial Day time and a half pay is optional and relies on company policy or labor contracts. Consult your employer for details.

Is Independence Day paid at time and a half?

Independence Day does not guarantee time and a half pay. Employers decide based on their policies or any labor agreements.

Is Labor Day paid at time and a half?

Time and a half pay on Labor Day depends on your employer's rules or union agreements. It is not federally mandated.

Is Columbus Day paid at time and a half?

Columbus Day time and a half is not a federal requirement. Pay rates depend on the company’s policy or collective bargaining agreements.

Is Veterans Day paid at time and a half?

Veterans Day is not automatically paid at time and a half. The pay rate depends on the employer’s policy or any applicable labor agreements.

Is Thanksgiving Day paid at time and a half?

Thanksgiving Day pay at time and a half is not mandated by law. Employers may offer it based on their policies or agreements.

Is Christmas Day paid at time and a half?

Christmas Day pay at time and a half is determined by company policy or labor agreements. It is not required by federal law.

How BeforeSunset AI Can Revolutionize Your Workday

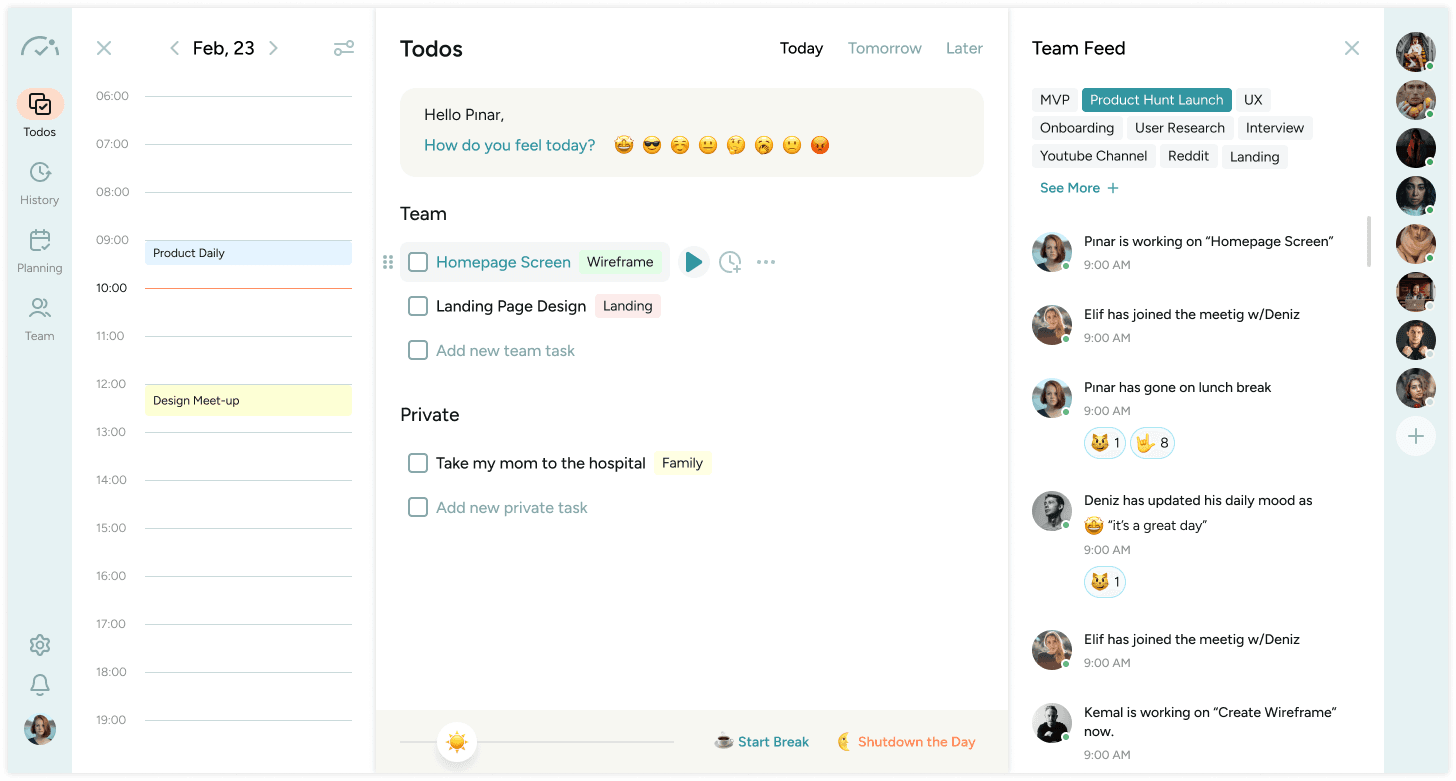

In the modern workplace, balancing productivity and well-being is crucial. BeforeSunset AI and its team version provide an AI-powered workspace that ends workday chaos by promoting teamwork, respecting privacy, preventing burnout, and reducing distractions.

Here’s how it can have a huge impact on your work and team dynamics:

Time-Blocking for Efficiency:

By turning your to-dos into the perfect schedule, BeforeSunset AI ensures that each task is assigned to the optimal time of day. This helps you maintain a regular workday structure, maximizing productivity during your normal workday hours.

Managing Additional Holidays and Extra Hours:

With BeforeSunset AI, planning for additional holidays and managing extra hours becomes seamless. The AI assistant helps you allocate tasks around these times, ensuring that you can handle peak work periods without burnout.

Part-Time Employees:

BeforeSunset AI also caters to part-time employees by allowing them to manage their schedules efficiently. This flexibility is crucial for part-time workers who need to balance multiple responsibilities. The tool helps them make the most of their limited work hours by prioritizing essential tasks.

Straight Time Rate and Task Prioritization:

The AI-powered system ensures that you can manage tasks effectively within your straight time rate. By prioritizing tasks that need to be completed during regular working hours, BeforeSunset AI helps you avoid unnecessary overtime and stay focused on key responsibilities.

Key Differences in Team Dynamics:

The team version of BeforeSunset AI highlights the key differences in individual and team workflows. By setting goals with team tags and categorizing to-dos, teams can work towards common objectives while also respecting individual work styles.

Analytics and Progress Tracking:

BeforeSunset AI provides detailed analytics to track your progress and that of your team. This includes monitoring your team’s extra hours and ensuring that everyone stays within their normal workday limits. The tool also helps in managing capacity and resources by giving an overview of each member’s workload.

Work-Life Balance:

One of the standout features of BeforeSunset AI is its ability to balance work and personal lives on a single platform. This means you can separate and control your work and personal to-dos simultaneously, whether daily or weekly. This holistic approach ensures that personal well-being is not sacrificed for work productivity.

Team Bonding and Mood Tracking:

Understanding your teammates' availability, mood, and personal interests helps in building a cohesive team. BeforeSunset AI makes it easy to know if a teammate is available without causing distractions, fostering better communication and collaboration.

By incorporating these features, BeforeSunset AI and its team version not only enhance productivity but also create a balanced, healthy work environment.

The focus on individual and team well-being ensures that you can achieve your goals without sacrificing personal health, making it an indispensable tool in today’s fast-paced work culture.